Hey there, dear entrepreneurs! Ever wondered what seed funding is all about? Well, you’re in the right place. Seed funding is like the nurturing soil for your startup’s tiny seedling, providing it with the essential nutrients to grow into a mighty tree. In this blog, we’ll delve into the world of seed funding and help you understand its significance for building your dream business. So, let’s get started!

What is Seed funding?

Over 1,000 startups were selected by approved incubators under the Startup India Seed Fund Scheme (SISFS)

Seed funding is where the journey begins for most startups. It’s the initial round of funding that injects capital into your budding venture. Think of it as your startup’s lifeline, fueling your growth in return for a share of your company.

Initially, most entrepreneurs rely on personal savings or contributions from friends and family. In fact, a whopping 77% of small businesses kickstart their journey this way. But here’s where seed funding shines.

It not only provides a financial boost but also brings experienced investors on board. These investors understand the risks and offer invaluable expertise and networks.

When Should You Raise Seed Funding?

“Scale is important for a startup. Think big, but take one day at a time.”

-Kunal Bahl, Co-Founder of Snapdeal

Timing is crucial when it comes to seed funding. This stage is your chance to prove that your business concept works and can gain traction in the market. Show that your product aligns with customer needs, and watch that customer adoption rate climb. Investors want to see a promising trajectory and potential for returns on their investment.

Now, the big question is: how much should you raise? The average seed round funding is around $2.2 million, but the exact amount depends on your business needs. It’s essential to aim for enough to reach profitability or the next funding milestone comfortably. Remember, you don’t have to raise the maximum possible amount. Being prudent with your finances is a wise strategy.

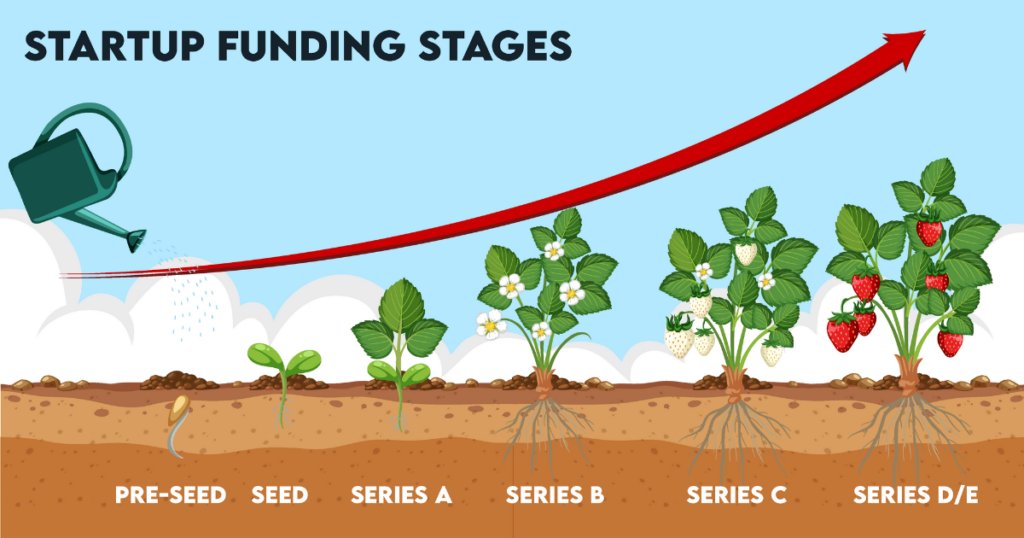

What Are the Different Stages of Funding?

Before we get too deep into seed funding, let’s explore the broader landscape of startup funding:

1. Pre-Seed Funding

- It’s the initial step for startups to validate ideas and build an MVP. Small investments from founders, friends, family, or angels.

- Focus on testing product viability. Seed capital comes from personal savings, loans, or investors.

2. Seed Funding

- Follows pre-seed, the first formal funding round. Capital from angels, VCs, or crowdfunding for product development and early traction.

- Obtained via equity, convertible notes, or loans.

3. Series A Funding

- After seed funding, it supports growth and scaling with larger VC investments.

- Focus on revenue generation and refining the business model, requiring product-market fit.

4. Series B Funding

- For further scaling, substantial investments are made. Emphasis on customer acquisition, partnerships, and entering new markets.

- Requires strong revenue growth and market dominance.

5. Series C & Beyond

- Startups can raise significant capital for global expansion or IPOs. Led by late-stage VCs or PE investors.

- Requires a clear path to profitability and sustainable growth.

Moving Investors Through the Stages

Building strong relationships with potential investors is key.

Just like your sales funnel, you can move potential investors through different stages of raising seed funding. Start by identifying qualified investors, filtering them to find the right fit, and maintaining regular communication to keep them engaged.

How to Get Seed Funding for Your Startup?

Getting seed funding for your startup is crucial, and it requires a systematic approach just like your sales and marketing efforts. Imagine it as a funnel, much like the one you use in B2B enterprise business sales and marketing:

- Attracting and Adding Leads

- Nurturing Leads

- Serving and Supporting customers

However, securing seed funding isn’t without its challenges. Early-stage startups face obstacles such as:

- Product/Service: Often, startups are in the idea validation stage with little brand value. Lack of funding can hinder the development of a Minimum Viable Product (MVP).

- Customers: Acquiring customers and gaining market acceptance can be a struggle. Building trust among customers is vital during the initial stages.

- Processes: Founders might lack expertise in formalizing team culture and hiring the right personnel.

- Business Model: Defining revenue channels, unit economics, and financial projections can be challenging.

Conclusion

Seed funding is the nurturing soil for your startup’s growth, providing vital resources in exchange for a stake in your venture. Timing is key, and demonstrating product-market fit is crucial when seeking seed funding. Remember, you don’t have to raise the maximum amount, and building strong investor relationships is vital for success.

Are you a promising startup looking for funding, support, and guidance?

Cool! Mail us at pitch@bventure.com