This blog gives you a simple introduction on how to apply to and do well at top VC (Venture Capital) firms. It’s a starting point for your learning. Once you understand the basics, you can explore more by doing additional research.

Ever dreamt of turning your startup dreams into the next Google or Facebook? Welcome to the world of Venture Capital (VC), where innovation meets investment. As a leading venture capital firm, in this blog, we are going to learn the secrets to thriving in the fast-paced realm of top VC firms. From essential skills to overcoming challenges, this comprehensive guide is your roadmap to success in the startup ecosystem.

What is Venture Capital?

Venture capital serves as the lifeblood for early-stage startups, offering funding, mentorship, and strategic guidance. In return, VC firms gain ownership stakes and actively participate in steering these promising companies towards success.

In simple words, VC is money invested in a business, usually a start-up, seen as having strong growth potential, provided by investors expecting a high return on.

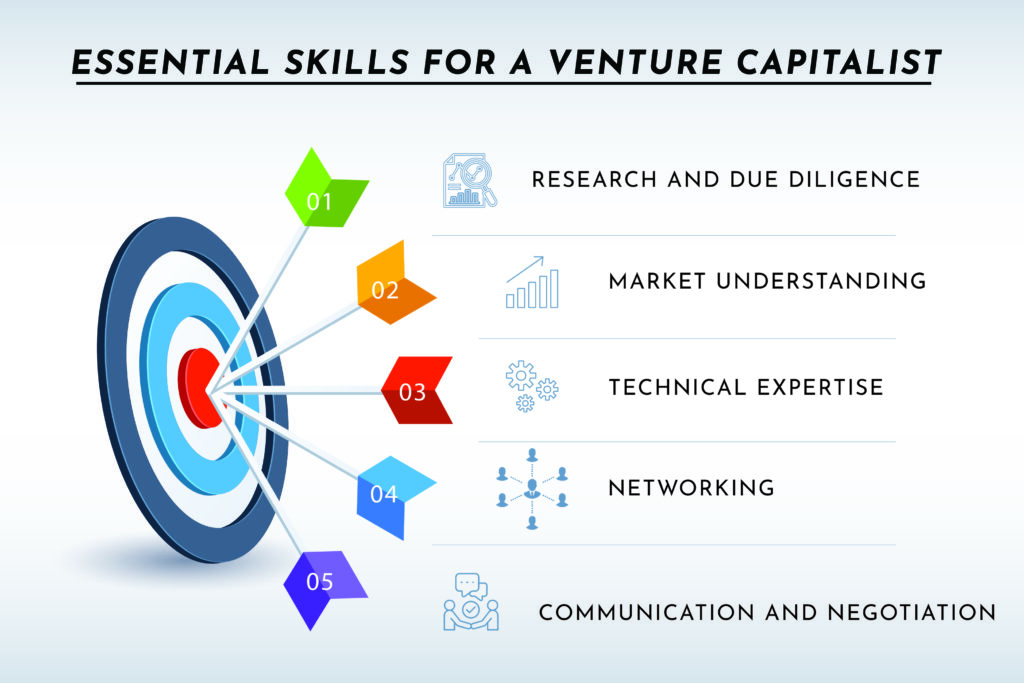

Essential Skills for a Venture Capitalist

As a venture capitalist, your success largely depends on the development of a versatile skill set. It is important to acquire these skills before investing in startups or high-growth businesses. Here are some key skills:

Research and Due Diligence

Rigorously research target companies, technologies, and markets. Follow industry trends and keep up with the latest technology.

Market Understanding

Grasp market dynamics, analyze trends, and identify sectors with high growth potential. Gain a thorough understanding of the competitive landscape and regulatory environment.

Technical Expertise

Differentiate between innovation leaders and laggards by understanding core technologies within your focus sectors.

Networking

Build a strong network for sourcing deals, exiting investments, and accessing valuable resources. Attend conferences, join professional associations, and leverage social media.

Communication and Negotiation

Communicate clearly and persuasively. Adeptly negotiate valuations, deal structures, and shareholder rights.

By honing these skills, you can excel in your career as a venture capitalist and drive value for your portfolio companies while generating attractive returns for investors.

Challenges in Venture Capital

Venture capitalists face various challenges. Some of them are;

Access to Deals: Limited high-quality companies are available, requiring extensive screening and information sifting.

Competition Among Investors: Fierce competition for deals, with VCs vying to convince entrepreneurs to choose their funding.

Time Constraints: Difficulty finding investors with the right balance of expertise and availability.

Economics: Economic downturns and upturns impact funding availability.

Limited Funds: VCs working with limited funds must be selective about investments.

Regulatory Changes: Dealing with regulatory changes affecting industry.

Venture capitalists are always on the lookout for the next big idea, evaluating not just the product or service but also the team behind it.

Standing Out in VC

Ready to shine? To excel among other startups, you need to follow these steps;

Build Your Brand: Share insights on social media, blogs, podcasts, or newsletters. Showcase achievements, awards, and testimonials.

Develop Your Unique Value Proposition (UVP): Differentiate yourself based on background, skills, network, vision, or style.

Expand Your Network and Relationships: Attend events, join communities, offer help, and leverage existing relationships.

Learn from the Best: Seek mentorship, and read books, articles, or case studies to learn best practices from successful VC professionals.

Deliver Results and Impact: Source, evaluate, and close high-quality deals. Provide value-added support to portfolio companies.

Seek Feedback and Improvement: Ask for feedback, conduct self-assessments, and continuously seek improvement.

Venture Capital Financing Process

Venture Capital’s financial process involves six steps. They are;

Deal Origination and Screening: Present a business plan to a VC firm or angel investor for consideration.

Due Diligence: Thoroughly investigate the company’s business model, products, and management.

Investment Pledge: VC firms or investors pledge capital in exchange for equity, usually provided in rounds.

Active Role: VC firms take an active role in advising and monitoring the funded company’s progress before releasing additional funds.

Exit Plan: The investor exits through a merger, acquisition, or IPO after a period of four to six years.

Conclusion

In a nutshell, venturing into the world of Venture Capital can be both thrilling and challenging. Armed with essential skills, an understanding of potential hurdles, and strategies to stand out, you’re now better prepared to navigate the startup landscape. Remember, building a personal brand, fostering relationships, and delivering impactful results are key.

If you need funding or mentorship, we are ready to help you, pitch your startup @ pitch@bventure.com

Turn your dreams into reality!